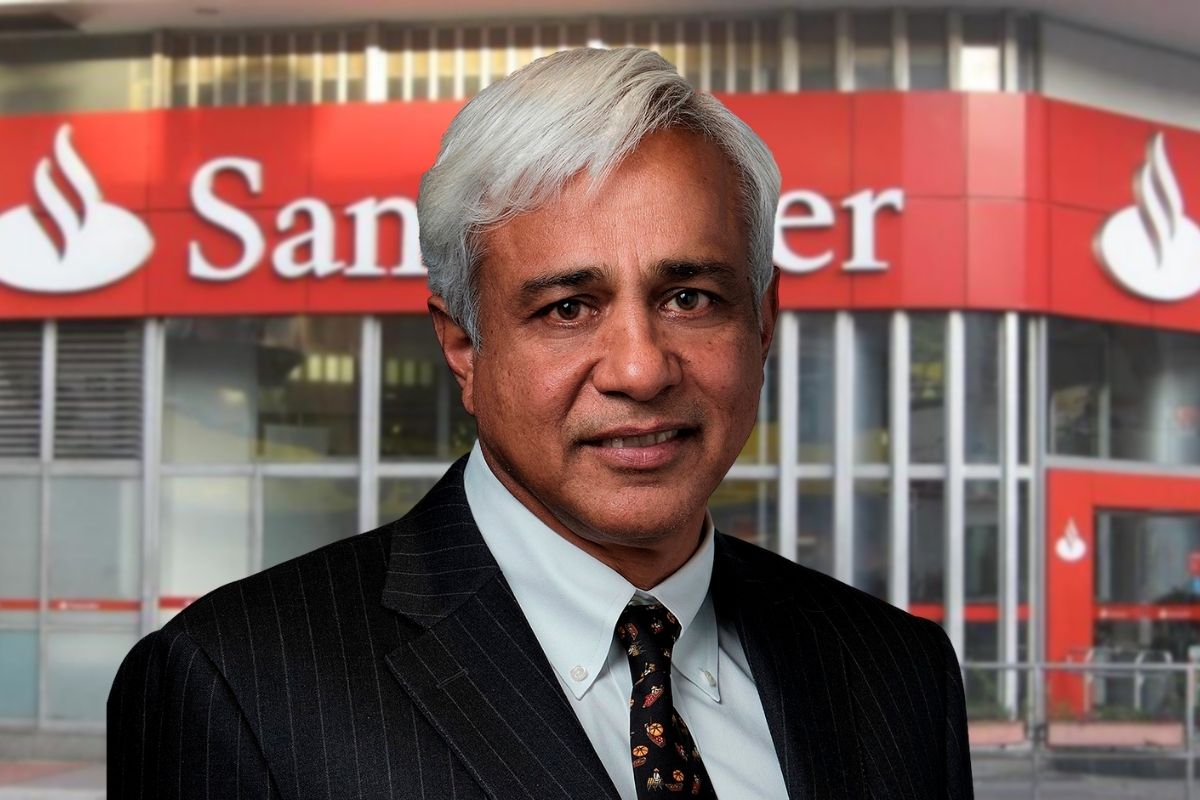

The search for a new captain at 2 Triton Square is officially over. On Friday, January 30, 2026, Santander UK confirmed that Mahesh Aditya will become its next Chief Executive Officer, effective March 1. The move signals a deliberate pivot toward technical stability as the bank begins the gruelling process of absorbing TSB Banking Group.

Aditya isn’t a newcomer to the building. He’s been sitting on the Santander UK board as a non-executive director since October 2025, a four-month “look under the bonnet” that the bank hopes will ensure a seamless transition.

He replaces Mike Regnier, who is stepping down after a four-year stint that culminated in the massive £2.65 billion deal to buy TSB from Spain’s Banco Sabadell.

The “Fixer” Strategy

While many expected a traditional retail banking veteran, Santander has instead reached for a heavyweight in risk management. Aditya is currently the Group Chief Risk Officer for the global parent company, Banco Santander. His reputation in the City is that of a “fixer”—the man you call when you have a massive integration project that cannot afford to fail.

Look at his 2019 stint in the States. That’s the real blueprint here. While running Santander Consumer USA, Aditya wasn’t just a figurehead; he was the one actually unpicking those messy regulatory knots and smoothing out the governance headaches that had plagued the firm for years. It was grunt work, honestly. But in 2026, with the FCA breathing down the neck of every digital bank in the UK, that kind of experience isn’t just a “plus” but essentially a golden ticket.

Aditya isn’t just coming in to keep things tidy; he’s overseeing a massive £400 million cost-saving mission. Santander’s internal ‘One Transformation’ plan is basically a digital organ transplant—they aren’t just merging with TSB; they’re planning to scrap TSB’s entire old IT system and move five million customers onto their own global ‘Gravity’ cloud platform by 2027. It’s a high-stakes move that explains exactly why a risk officer is now in the top seat.

Also Read: Dave Fishwick Net Worth: How Much is the Bank of Dave Millionaire Really Worth?

The TSB Integration Hurdle

So, why now? Mike Regnier was blunt about the timing. In a statement released via the London Stock Exchange’s RNS service, he noted that the TSB integration is a multi-year beast. “I had intended to move on after four to five years,” Regnier admitted, suggesting it was better for a new leader to own the project from start to finish rather than changing horses mid-stream in 2027.

The stakes are enormous. This merger, expected to fully close this quarter, will move Santander UK into the spot of the third-largest personal current account provider in the country. It adds five million customers and a £34 billion mortgage book to the pile. But as anyone who remembers TSB’s 2018 IT meltdown knows, merging two banking platforms is fraught with danger.

There’s also a bit of a ‘shield’ at play here. The City is still buzzing about those May 2025 reports that NatWest tried to lob in a cheeky £11 billion bid for Santander’s UK arm. It was a bold move, but Executive Chair Ana Botín wasn’t having any of it.

By rejecting that ‘low-ball’ offer and now installing a heavy hitter like Aditya, she’s essentially built a fortress around the UK business. They aren’t looking to sell; they’re looking to dominate.”

Also Read: Sandy Easdale: Scotland’s Business Tycoon Who Built a £1.46 Billion Empire

What’s Next for Customers?

For the nearly 28 million combined customers, the immediate message is: don’t panic. For now, Santander and TSB remain legally separate entities with their own banking licences. This means your FSCS protection still applies to each individual—up to the £85,000 limit per person, per institution.

The timing is actually quite handy for savers. Since December 2025, the official FSCS safety net has jumped from £85,000 to a much meatier £120,000. Here’s the clever bit: because Santander and TSB are still running on separate banking licences for the next few months, you could technically stash £120,000 in both and be fully protected for a total of £240,000.

It’s a temporary ‘merger loophole’ that won’t last forever once Aditya finishes the legal paperwork, but for now, it’s a massive win for anyone with a decent bit of brass in the bank.

Aditya’s primary mission will be moving everyone onto a single, unified technology platform without the service outages that usually make front-page news. It’s a “back-to-basics” approach focusing on the plumbing of the bank rather than flashy new marketing campaigns.

The City has reacted with a collective nod of approval. By appointing a man who has spent 30 years at Citi, JPMorgan, and Visa, Santander is prioritising the “safe pair of hands” over the visionary disruptor.

Anyway, it’s a big job for Aditya. Taking over a high street giant just as it attempts a massive structural rewire is no small feat. We’ll see how his first 100 days pan out when he officially takes the helm this March.

Also Read: Solution Bank: Why Every A-Level Maths Student Needs This Game-Changer